prince william county real estate tax due dates 2021

The due date for 2nd half 2021 real estate taxes is december 6 2021. Prince william county real estate tax due dates 2021 Monday May 30 2022 Edit.

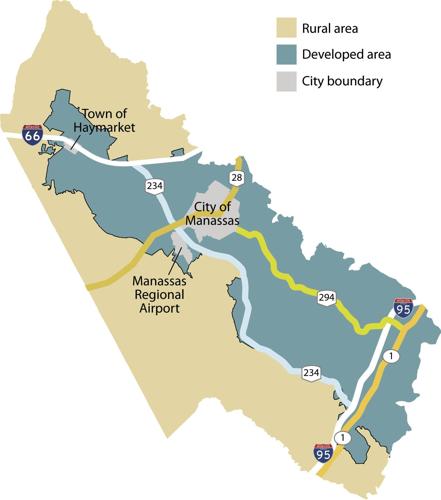

Prince William County Virginia.

. How will i recieve my pets license and annual renewal notice. Business personal property filing deadline. Personal Property Tax Vehicle License Fee.

Prince William County Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. Prince William County Virginia Property Tax Go To Different County 340200 Avg. Sign Up Log In Tags Property Tax Board Of Supervisors Real Estate Tax Bills Ann Wheeler.

Please log in or sign up for a new account and purchase a subscription to continue reading. View all 4 listings available in Prince William County with an average price of 293854. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

Prince william county tax collector va The county is proposing a decrease in the residential real estate tax rate from 1115 per 100 of assessed value to 105. Prince William County personal property taxes for 2021 are due on October 5 2021. The first monthly installment is due July 15th.

Prince william county real estate tax due dates 2021 Monday May 30 2022 Edit. Submit Business Tangible Property Return. The second and all subsequent installments are due on the 5th of each month with the final payment being due on June 5th.

State Estimated Taxes Due Voucher 1 June 5. By mail to po box 1600 merrifield va 22116. Prince william county real estate tax due dates.

4379 Ridgewood Center Drive Suite 203. Real Estate Tax 2nd half of Fiscal Year Stormwater Fee. From the Prince William County Government.

Process business account actions. If customers have not received a tax bill for their vehicles and. Report High Mileage for a Vehicle.

Every taxpayers levy. Personal Property Taxes Due. Real Estate Assessments - Prince William County Virginia.

Prince William Wants To Hike Property Taxes Introduces Meals Tax Prince William County Va Real Estate Market Realtor Com Qts Prince William Landowners Propose Massive Data Center Campus Washington Business Journal. Report a Name Change. Tax Relief for the Elderly and Disabled Mobile Homes Application Due Date.

Ad Search Free Property Listing Websites - Find results on Seekweb. State Income Taxes and State Estimated Taxes. The due date for 2nd half 2021 real estate taxes is december 6 2021.

Prince William County extends property tax filing deadline Press Release March 23 2021 at 225pm To help businesses impacted by the economic impact of COVID-19 the County has extended the. Learn all about Prince William County real estate tax. Prince William County Real Estate Assessor.

Hi the county assesses a land value and an improvements value to get a total value. State Income Tax Filing Deadline. 09 of home value Yearly median tax in Prince William County The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

Business License Renewals Due. Prince William County Government. With due diligence examine your tax levy for all other possible errors.

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements House Location Survey Plat. One-half of the taxes on all personal property and one-half of the taxes on all real property will be due and payable the first day of October 2021. Report a Vehicle SoldMovedDisposed.

When are property taxes due in Virginia County Prince William. If your account numberRPC has less. Report a New Vehicle.

What is the property tax rate in. Report High Mileage for a Vehicle. Real Estate Tax - Prince William County Virginia.

Prince William County Virginia. Their phone number is 703 792. 4000 County Avg 6200.

Press Release July 17 2021 at 1137am Prince William County real estate taxes for the first half of 2021 are due on July 15 2021. 15 Staff Reports Jul 15 2020 Updated Jul 15 2020 2 Darren Hester Thank you for reading. For example a home valued at 400000 in 2020 would be worth 428000 for tax purposes in 2021 at a 7 increase.

Copies of subdivision plats are available for purchase at the Clerk of Circuit Court Land Records located at 9311 Lee Avenue 3rd Floor Manassas VA 20110. You will need to create an account or login. Prince William supervisors extend deadline for real estate taxes to Oct.

The tax rate is express in dollars per one hundred dollars of assessed value.

Class Specifications Sorted By Classtitle Ascending Prince William County

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Prince William Supervisors Dig In On Comprehensive Plan Update Headlines Insidenova Com

Fairfax County Officials Ask Prince William County To Reconsider Pw Digital Gateway Proposals Dcd

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Prince William County Launches A New Show Called County Conversation

2022 Best Places To Buy A House In Prince William County Va Niche

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

Prince William County Park Rangers New On Call Number Effective April 1 2022

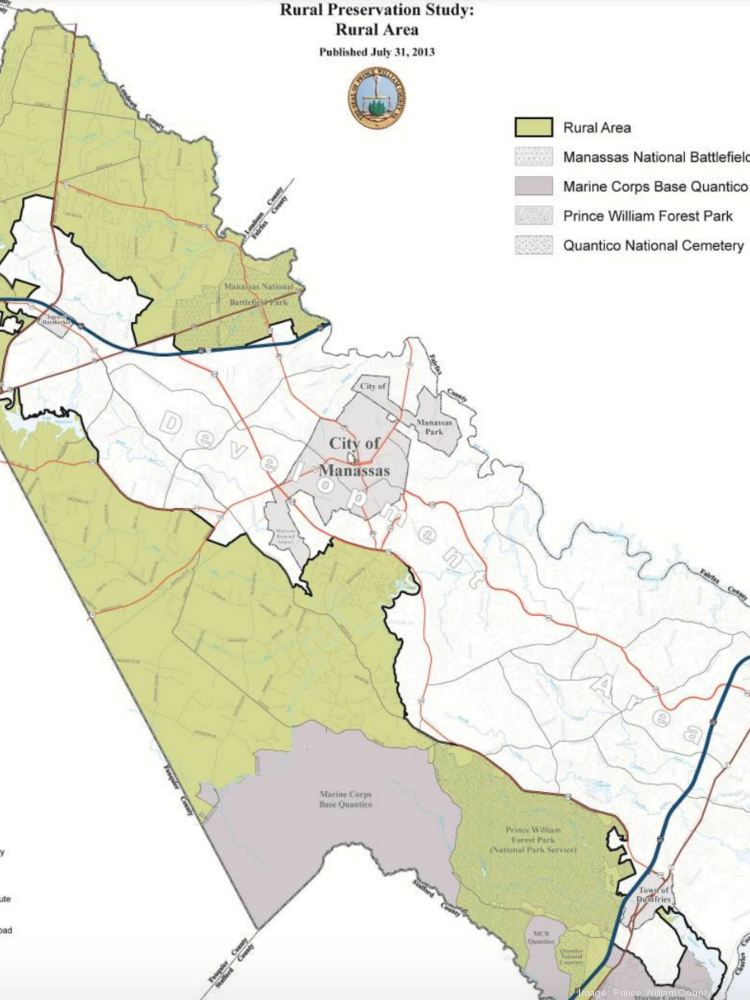

Data Center Opportunity Zone Overlay District Comprehensive Review

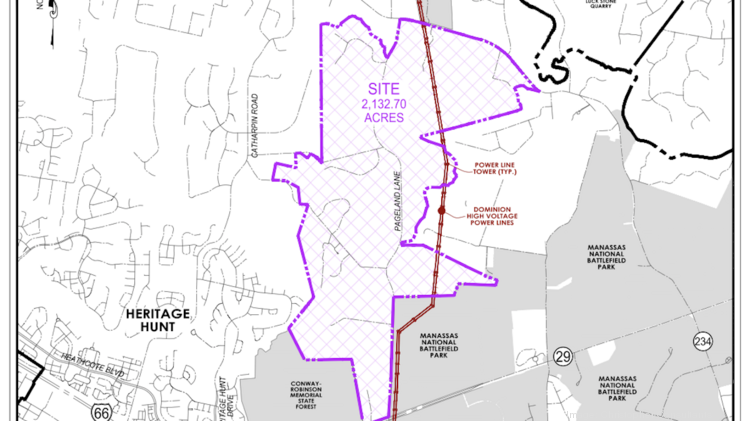

Qts Prince William Landowners Propose Massive Data Center Campus Washington Business Journal

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Personal Property Taxes For Prince William Residents Due October 5

April Is Litter And Illegal Dumping Enforcement Month

Where Residents Pay More In Taxes In Northern Va Wtop News

Qts Prince William Landowners Propose Massive Data Center Campus Washington Business Journal